What Exactly is Sustainable Finance?

The concept of sustainability has spread from international public discourse and development to private sector businesses, including players in the financial markets. Last week, representatives from Green Token and Civic Exchange had a casual chat on sustainable finance on Twitter Space. More specifically, we looked at the application of sustainability in the financial industry.

The term “sustainable finance” is used to describe any type of financial activity that considers sustainability, through all asset classes (which would include equity, debt, both bonds and loads, and other asset classes including commodities or derivatives), and across different goods and services, varying from corporate loans to mutual funds with shares of sustainable companies offered to retail investors.

What is the Role of the Financial System?

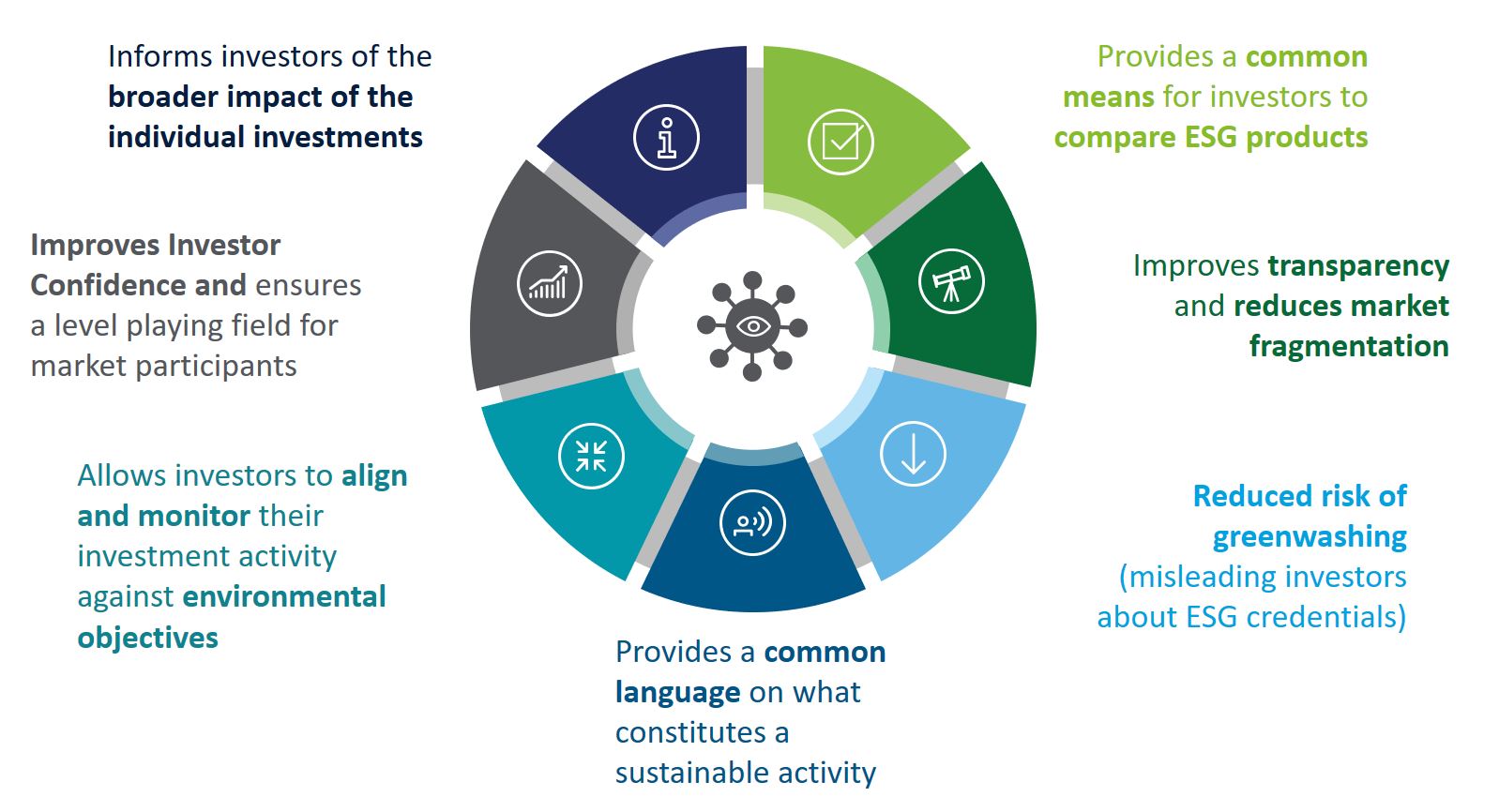

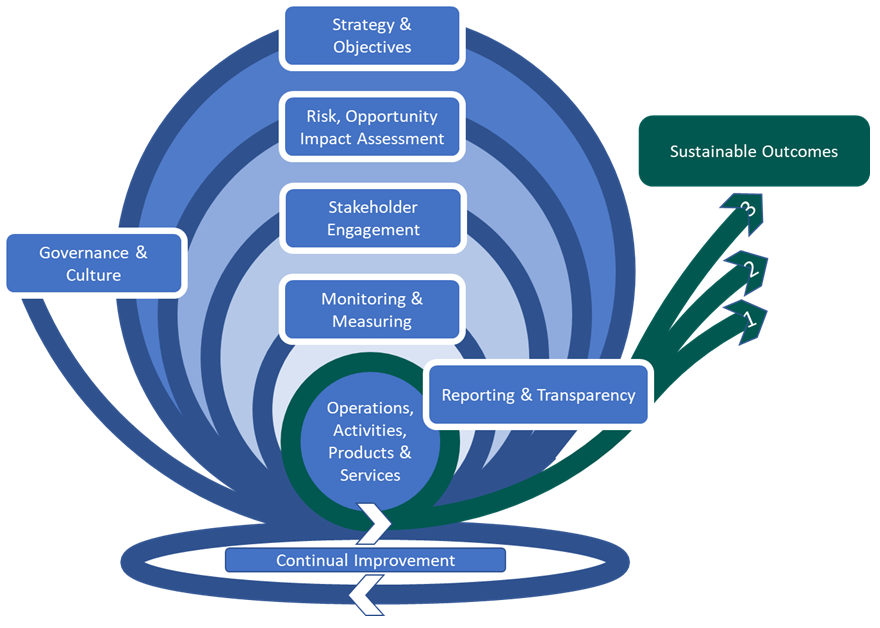

Financial institutions have a significant impact on funding and raising public awareness of sustainability-related issues, whether through enabling the development of alternative energy sources or by assisting companies that employ ethical and sustainable labour practises. Investment choices that consider an economic activity’s environmental, social, and governance (ESG) concerns are referred to as sustainable financial decisions.

Generally speaking, mainstream banks, insurers, asset managers, asset owners, stock exchanges, ratings agencies, and other parts of the financial system have been carrying out the trend towards sustainable finance transactions, products, and offerings, occasionally through a dedicated sustainability division. Additionally, the number of smaller, specialised pure-play green or ESG financial enterprises has increased.

However, financial companies have been tempted and prone to labelling their operations or offerings “sustainable” without harmonising definitions given the rising awareness of sustainability. Industry standards and monitoring have developed as a result of regulatory action as well as self-policing from industry organisations. On how to include environmental, social, and governance aspects into lending and investing operations, including scores and criteria for portfolio analysis, there is also growing agreement. Furthermore, the usage of specific, labelled, and specified sustainable financial instruments, such green bonds, has gained popularity in the domain of sustainable finance.

What are Green Bonds?

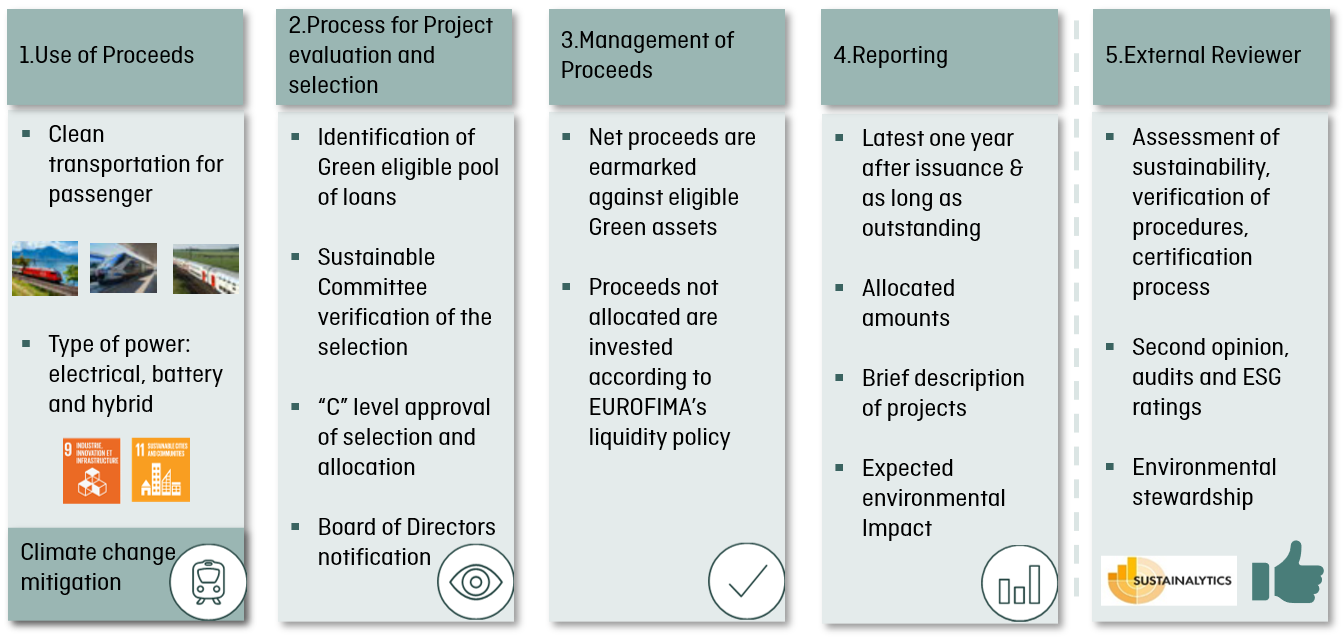

Capital-raising and investment for both new and ongoing environmental projects are made possible by green bonds. The Green Bond Principles (GBP), which aim to assist issuers in financing environmentally sound and sustainable projects that promote a net-zero emissions economy and safeguard the environment. GBP-aligned issuance should offer an investment opportunity coupled with verifiable green credentials. The GBP encourages a step shift in openness that makes it easier to follow money to environmental initiatives while also attempting to improve insight into their anticipated impact by suggesting that issuers report on the usage of Green Bond revenues.

Green Bond Principles

Green bond issuance has been largely self-defined and self-policed by broad, industry-led principles and definitions.

According to the International Capital Market Association (ICMA), the Green Bond Principles have 4 core components:

a) Use of Proceeds

The utilisation of the proceeds of the bond for Green Projects should be appropriately described in the legal documentation. Clear environmental benefits should be listed, including renewable energy, sustainable water and wastewater management, climate change adaption, terrestrial and aquatic biodiversity conservation.

b) Process for Project Evaluation and Selection

Issuer of the Green Bond should clearly communicate to investors on the environmental sustainability objectives, the process of how the Green Projects fit within the categories, and related eligibility criteria.

c) Management of Proceeds

The issuer should track the net proceeds of the Green Bond appropriately, credit them to a sub-account, transfer them to a sub-portfolio, or do one of a number of other things, and attest to them in a proper internal procedure related to lending and investing activities for green projects.

d) Reporting

An annual report should include a brief description of the projects, the amounts allocated, and their expected impact on the environment. This report shall be renewed annually until full allocation and on a timely basis in case of material developments. It is also recommended to appoint an external review provider (as second-party opinion; verification; certification; or green bond scoring/rating), so as to confirm the alignment with the Green Bond Principles. These second-party opinions on the environmental credentials of the green bond can be seek from organisations such as Sustainalytics, a leading independent ESG and corporate governance research, ratings and analytics firm.

The Rise of Regulations and Standardisations

The underlying economic activity being financed is the subject of an increasing amount of regulatory activity in regard to sustainable finance, rather than financial products or disclosures. Between jurisdictions, particularly between China and the OECD countries, there has historically been some disagreement on these topics.

While current market-led rules in the West have not permitted any form of fossil-fuel financing, China has long permitted “clean coal” and other forms of “clean utilisation of fossil fuels” to be financed via green bonds. China, meanwhile, announced a proposal in 2020 to exclude clean fossil fuels from a revised norm, bringing it in line with other nations and market-driven rules, as a sign of increased efforts toward harmonisation of sustainable finance.

Introducing E.U. Taxonomy

Regulators have been working to define sustainable activities in ever-clearer terms. The European Union has made the most progress in this area. The European Union Taxonomy establishes performance benchmarks (sometimes known as “technical screening criteria”) for economic activities, broken down by sector and sub-sector. It was initially published in draught form in March 2020.

The taxonomy is unconcerned with the type of financing or financial instruments used. Any investment or lending for a recognised activity, whether through a loan, a green bond, or project financing, would count as sustainable once the taxonomy is in effect.

The high amount of descriptive material provided by the EU taxonomy for each and every covered sub-sector is noteworthy.

Activities must significantly advance at least one of the following six environmental goals in order to qualify as “green”: pollution prevention and control, biodiversity preservation, climate change adaptation, sustainable use and protection of water and marine resources, and the preservation and restoration of ecosystems and biodiversity. Additionally, they must specifically uphold the other five objectives and adhere to a number of basic safety requirements.

Sector example under the E.U. Taxonomy: Cogeneration Technology

If it can be shown that the life cycle consequences for producing 1 kWh of heat/cool and power are below the falling threshold, any cogeneration technology may be included in the taxonomy. Declining threshold: The cogeneration threshold is 100 gCO2e/kWh for combined heat/cool and power.

- In order to achieve net-zero CO2 emissions in 2050, this threshold will be decreased every five years.

- When the first request for taxonomy approval is made, the requirement must be met.

- In order to continue operations after 2050, it must be technically possible to achieve net-zero emissions.